Is Now the Time to Sell? Here’s Why the Answer Might Be Yes

If you've been holding off on listing your home due to concerns about buyer demand, here’s a sign it might be time to reconsider. After months of high mortgage rates keeping buyers on the sidelines, the market is starting to shift in favor of sellers.

Rates are coming down, thanks to various economic factors, and the Federal Reserve recently cut the Federal Funds Rate for the first time since March 2022. While the Fed doesn’t directly control mortgage rates, their decision sets the stage for further declines in mortgage rates, bringing more buyers back into the market.

According to Lisa Sturtevant, Chief Economist at Bright MLS, this shift is creating renewed interest among buyers and could soon bring more sellers into the market as well:

"A drop in the cost of borrowing will help fuel more homebuyer demand . . . Falling rates will also bring more sellers into the market."

As Rates Fall, Buyer Activity Rises

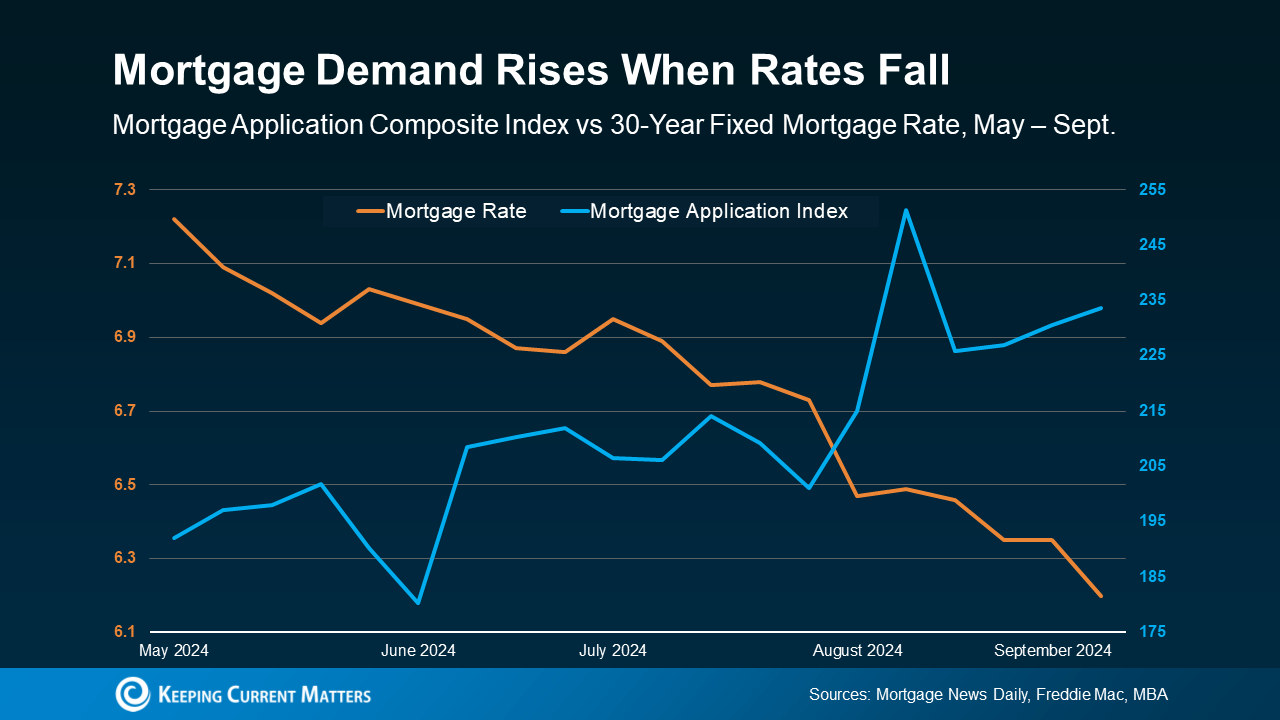

Recent data confirms this trend. The graph below from the Mortgage Bankers Association (MBA) shows a clear relationship between falling mortgage rates and rising buyer activity. As mortgage rates decline, the number of mortgage applications increases, signaling that more people are re-engaging in the home-buying process.

This aligns with the latest update from the National Association of Realtors (NAR), which reported an increase in home sales in July after four consecutive months of decline. More buyers entering the market means more competition for homes, potentially leading to higher offers and quicker sales.

Edward Seiler, AVP of Housing Economics at the MBA, adds that this trend is expected to continue:

“MBA is expecting that slower home-price appreciation, coupled with lower rates, will ease affordability constraints and lead to increased activity in the housing market.”

What Does This Mean for You?

If you're a homeowner considering selling, the increase in buyer activity works to your advantage. More buyers mean more competition, which could lead to higher offers and shorter market times for your property. Additionally, as mortgage rates continue to decline, even more buyers will likely enter the market, increasing your chances of selling at a favorable price.

Bottom Line

With mortgage rates falling and buyer interest rising, now might be the perfect time to sell. Don’t miss out on the increased demand—partner with a local real estate agent to get your home market-ready and take full advantage of the current trend.

(Source: Keeping Current Matters)